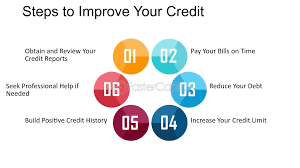

Step-by-Step Guide to Improving Credit Worthiness

Your credit worthiness is like your financial reputation — it tells lenders, employers, and even landlords whether they can trust you with money. If you’ve ever applied for a loan, bought something on credit, or used a mobile lending app, your credit worthiness determines whether you get approved, how much you can borrow, and what … Read more